Best Invoicing and Billing Software for Freelancers in 2025

Freelancers thrive on independence, but with that freedom comes the responsibility of managing their own payments, invoices, and client transactions. Choosing the best invoicing and billing software for freelancers can make the difference between chasing payments and enjoying steady cash flow. In 2025, digital tools have advanced to offer smarter automation, better payment tracking, and even integration with accounting platforms, making the invoicing process simpler than ever.

This guide covers everything you need to know — from the benefits of using such software, to the best features to look for, and a review of the top options available today.

Why Freelancers Need Specialized Invoicing and Billing Tools

Freelancing isn’t like working in a corporate environment where finance departments handle payment schedules. Instead, independent workers need to send invoices, track due dates, manage taxes, and ensure they are paid on time.

A robust invoicing and billing software for freelancers removes the guesswork by automating payment reminders, calculating taxes, converting currencies for international clients, and generating professional-looking invoices that enhance your credibility.

Without such tools, freelancers risk payment delays, mismanaged records, and tax headaches at year-end. In a competitive freelance market, efficiency and professionalism are non-negotiable.

Key Features to Look for in Invoicing Software

Not all invoicing tools are created equal. When searching for the perfect invoicing and billing software for freelancers, consider these must-have features:

-

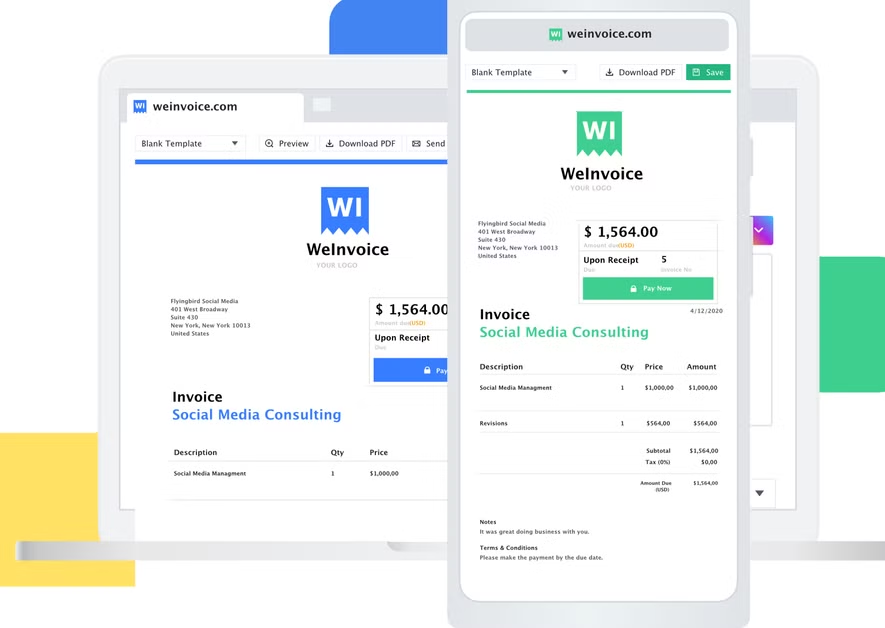

Customizable Invoice Templates – Personalization ensures your brand is reflected in every invoice.

-

Recurring Billing – Essential for retainer clients or ongoing projects.

-

Multiple Payment Gateways – Support for PayPal, Stripe, bank transfers, and credit cards widens your payment options.

-

Expense Tracking – Helps monitor project profitability and overall financial health.

-

Tax Calculations – Automates sales tax or VAT based on client location.

-

Multi-Currency Support – Ideal for freelancers working with international clients.

-

Mobile App Access – Manage invoicing on the go from your phone or tablet.

Benefits of Cloud-Based Solutions

In 2025, most invoicing and billing software for freelancers operates in the cloud. Cloud-based systems mean your data is stored securely online and accessible from anywhere. This flexibility is crucial for freelancers who may work from different locations or travel frequently.

Cloud-based solutions also offer:

-

Automatic Backups – Prevent data loss.

-

Real-Time Updates – Sync across devices instantly.

-

Collaboration Options – Share access with accountants or bookkeepers.

How Invoicing Software Improves Cash Flow

One of the biggest struggles freelancers face is late payments. With built-in reminders, instant payment links, and recurring invoice options, invoicing and billing software for freelancers helps reduce payment delays dramatically.

For example, automated reminders can be set to notify clients a few days before the due date and again if the invoice becomes overdue. This system ensures freelancers spend less time chasing payments and more time working on billable tasks.

Best Invoicing and Billing Software for Freelancers in 2025

Below are some of the best platforms currently available:

1. FreshBooks

A user-friendly cloud-based solution that offers invoicing, expense tracking, and time logging. It’s perfect for beginners who want an all-in-one tool.

2. QuickBooks Online

Well-known in accounting circles, QuickBooks offers strong invoicing features, tax tracking, and reporting tools that scale as your freelance business grows.

3. Wave

A free option with professional invoicing capabilities, payment processing, and expense tracking. Great for budget-conscious freelancers.

4. Zoho Invoice

Part of the Zoho business suite, Zoho Invoice allows customization, recurring billing, and integration with other Zoho apps.

5. Paymo

Combines invoicing with project management tools, making it ideal for freelancers who manage multiple projects simultaneously.

Integrating Invoicing Tools with Other Business Software

The best invoicing and billing software for freelancers integrates seamlessly with accounting platforms, project management tools, and CRM systems. This integration saves time by reducing data entry, improving accuracy, and giving you a complete view of your finances and client relationships.

For example:

-

Connect your invoicing tool to Trello or Asana for automatic billing when projects are completed.

-

Link with accounting software for real-time tax calculations.

-

Sync with payment gateways for instant payment processing.

Tips for Choosing the Right Software

-

Define Your Needs – Make a list of must-have features before browsing options.

-

Test with Free Trials – Many platforms offer 14 to 30-day trials so you can test usability.

-

Consider Your Budget – While free tools are tempting, premium plans often save time and improve professionalism.

-

Check Customer Support – A responsive support team is essential if you encounter technical issues.

The Future of Invoicing for Freelancers

With AI integration and blockchain payment solutions emerging, the next generation of invoicing and billing software for freelancers will likely be more secure, automated, and predictive. AI can help detect late payment patterns, recommend follow-up strategies, and even draft polite payment reminder emails.

Freelancers who adopt these technologies early will enjoy a smoother client payment experience, stronger cash flow, and more time to focus on creative or technical work.

Final Thoughts

The right invoicing and billing software for freelancers isn’t just a convenience — it’s a necessity in today’s competitive market. By automating the invoicing process, tracking expenses, and offering multiple payment options, these tools help freelancers maintain steady cash flow and a professional image.

Investing in reliable software means fewer payment delays, less manual work, and more time to grow your freelance business. Whether you choose FreshBooks, QuickBooks, or another tool, the key is to select a platform that matches your workflow and client needs.